Monthly ; Currency, VoA, Debt & Money Market Update

Read my note on Currency, India Macro, VoA, Debt and Money Market.

Download – Monthly Note

More about Kush Sonigara on Google+

Read my note on Currency, India Macro, VoA, Debt and Money Market.

Download – Monthly Note

More about Kush Sonigara on Google+

Key points:

Our Take

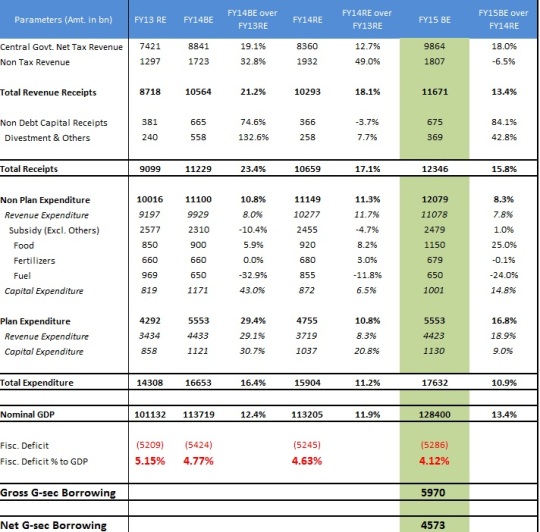

Finance Minister P. Chidambaram has kept up his promise to keep the deficit within the most reiterated red line of 4.8%. However the means by which he minimized the deficit is well known i.e. by rolling over the subsidy payments in the following year. Bond markets were more closely eyeing gross and net borrowing number which more or less were in line with market expectation however many doubt whether the same will be adhered to given high probability of India having someone else managing the finance ministry ahead. Demand supply dynamics at a net borrowing number of ~4.6tn seems favorable however above statement of increasing the FX reserves by USD15bn and RBI’s bias towards low SLR may dampen initial calculations. It wouldn’t be surprising if debt return outpaces equity in the next one year hereon.

Weak demand and reduced tax rate make the tax collection projections tad optimistic. The most watch and worrying factor, subsidy, is planned for INR 2.47lk cr. However unnatural movement in Oil and Fertilizer prices may bring up uncomfortable numbers. FM pegged FY15 growth at 5% and nominal growth at 13.4% which tentatively prices in an inflation (precisely GDP deflator) of 7.6%. Bond market’s reaction to budget is that of a non-event. Going forward, Fresh issuance & switch (500bn) calendar in addition to inflation and domestic currency will guide the markets.

More about Kush Sonigara on Google+

More about Kush Sonigara on Google+

I am working with a gross borrowing of ~6.50tn. However note that I haven’t considered cash balance which government will carry next year. Cash balance may range anywhere between 400-550bn. Hence gross borrowing then, excluding cash balance, should come down to 5.95-6.1tn.

Gilts of ~1.68tn will mature in FY15. Incorporating redemptions, net borrowing should come at around 4.8tn. Conventionally RBI raises 90% of its net borrowing via Gsec. Hence total net Gsec supply could come at around 4.3-4.4tn considerably low vs. 4.69tn of net borrowing in FY14

Note – I haven’t incorporated switch effect anywhere above. If government, which had already bought ~120bn of FY15 debt, switches ~200bn by FY14 end then above figure of 4.3-4.4tn for net supply should fall by similar amount i.e. 200bn to 4.1-4.2tn.

I would add duration at current levels however on an incremental basis with a minimum 2 year horizon.

More about Kush Sonigara on Google+

The Reserve Bank of India left repo and consequently reverse repo rate unchanged at 7.75% and 6.75% respectively. It also left CRR unchanged at 4.0%. This comes at a time when participants were debating over a 25bps or 50bps hike after steep rise in wholesale and retail inflation.

Key Facts:

Every governor has been peculiar in decision making and Mr. Rajan is no different. After an extreme uptick in WPI and CPI, primarily on the back of food articles, market more or less priced in a hike of at least 25bps with a tad hawkish stance.

Food article inflation which has been a structural issue is hovering in double digits since 11th five year plan. Last dozen of data shows this is continuing in the next five year plan as well. Rajan from start is pretty clear over its objective to tame inflation and inflation expectation.

RBI’s decision of status quo is drawn from steady core inflation. They believe food and vegetable prices will soon come off bringing down the headline wholesale and retail inflation substantially.

RBI said that at a time when uncertainty surrounding short term path of inflation is high, and given the weak state of economy there is merit in waiting for more data to reduce uncertainty.

More importantly RBI said it will be vigilant and check if the expected softening of food inflation does not materialize and translate into a significant reduction in headline inflation in the next round of data releases failing to which the Reserve Bank will act, including on off-policy dates if warranted.

Comments:

RBI’s action pulled down yields considerably down by ~12bps from ~8.90% to ~8.78%. Aggressive buying was limited as rate hike risk still persists after RBI clearly stated to act on off-policy dates as well.

Short term CD/CP rates receded after RBI’s surprising move. 2M/1Y CD rates fell ~30/15bps. Banks and corporates aggressively jumped in the market to raise funds via CDs and CPs respectively. Frugal government is expected to keep liquidity tight for a prolonged period.

Coming Inflation and growth numbers will hold a key importance in RBI’s decision making process. Anecdotal data suggests that vegetable prices have receded by ~40-60% m-o-m in early December. This if continues can bring down next number considerably down compelling RBI to keep rates untouched.

Bond market has taken a hit from a number of domestic and global factors. OMOs, which mightily supported bonds in the second half, are almost absent. Fiscal worries as well are driving investors jittery to some extent, this is even after Chidambaram succeeded in limiting previous year’s deficit at announced level.

Traders will wait for an update from US over its quantitative easing programme using which it had added more than a trillion dollars in the financial system. Strong pullback in its buyback quantum will be negative for the economy however the impact is not expected to be severe on the bond side. Note that FIIs cumulatively has sold bonds worth ~835bn since 22nd may when Fed first hinted pulling back its stimulus.

More about Kush Sonigara on Google+

Read my note on India Macro & Debt Market Update

More about Kush Sonigara on Google+

Read my note on Iran Nuke Saga & Economic update on UK, Eurozone and India.

Good piece from professors of NIPFP. Fiscal multiplier gives one an idea about how government spending/revenue impacts the final output of the economy. India’s growth has tumbled to a decade low due to a number of reasons. Faltering growth has only exacerbated government’s concern with regard to fiscal deficit. Authors in the paper present a framework for the estimation of fiscal multipliers.

Accordingly they list down below numbers after their assessment:

Expenditure

Capital Expenditure Multiplier: 2.45

Other Revenue Expenditure Multiplier: 0.98

Income

Corporate Tax Multiplier: -1.02

Every 100rs increase in capital expenditure will boost country’s GDP by Rs.245. Similarly for every rise in Rs.100 via direct tax collection GDP falls by Rs.102.

Not listing transmission mechanism (in the paper) but one should read it.

They conclude

Despite policy targets that have sought to raise the capital expenditure by the government, allocation for capital account expenditure continues to be a residual expenditure as observed in recent budgetary exercises. The high value of the estimated capital expenditure multiplier points to a high multiplier effect of capital expenditure on output, and underscores the need to prioritize capital expenditure.

Government is widely expected trim its plan expenditure in addition to payment delays and other stuff to limit its deficit number at 4.8% of GDP. Plan expenditure has two components – Capital and Revenue expenditure. In the previous year FM saved heavily on plan expenditure (primarily on revenue expenditure). Among other ministries rural is the one which is expected to take a big hit on its budgeted amount. Last year government set aside ~763bn for Ministry of Rural Development out of which they were allowed to spend only ~550bn on the back of last minute austerity. This year budgeted amount of the ministry was set at ~801bn. Let’s see how situation pans out this time. If post monsoon harvest falls out of line then probably a double whammy for rural population.

More about Kush Sonigara on Google+

Foreign investment in the Indian Government bond market

At a time when lots of chatter is going around with regard to domestic bonds being included in JP Morgan Index and easing some of the restriction over foreign investment in debt market, Ila Patnaik along with other co-authors writes up a paper presenting the logic foreign investment in the Indian Government bond market.

Listing down some text I found to be of importance

The share of the Government bonds outstanding that are owned by foreign investors is meager 1.6% as at end March 2013 far less than then emerging markets.

The Committee on Financial Sector Reforms chaired Raghuram Rajan also recommended steady opening of rupee denominated government and corporate bond markets to foreign investors.

When the policy rate is raised, there are two impacts. Borrowing becomes costlier within India, which reduces demand and thus cools the economy. In addition, when the interest rate in India is higher, more capital comes into India, and the rupee appreciates, which cools the economy. These two effects also work in reverse. When the policy rate is lowered, there is one channel working within India, where demand is increased. In addition, at a lower interest rate, less capital comes into India, and the rupee depreciates, which is expansionary. The second channel has been largely ineffective till date, owing to the capital controls that affect debt flows into India. Changes in the policy rate have a feeble impact on the rupee, as the channels through which foreign investment comes into Indian debt are clogged. While foreign investment into equity is open, equity investment has a low sensitivity to the policy rate. The main impact of monetary policy will come about through debt flows.

It is advantageous to Indian authorities if the bulk of global trading in the rupee takes place in India. When this activity takes place in India, it fosters a deep and liquid market with the comprehensive development of the bond-currency-derivative nexus. This will help improve the monetary policy transmission.

To the extent that foreign investors engage with Indian issuers on Indian soil, and to the extent that their currency trading activities take place in India, the revenue stream for financial services associated with these transactions will accrue to Indian financial firms. This will increase Indian GDP.

Percentage limits on foreign investment: Foreign ownership should be capped at a certain percentage of the outstanding government debt, such as at 10 or 15 percent of the total government debt.

More about Kush Sonigara on Google+

Banks in any country are the backbone of the economy. Primary role of banks is to cater the demand of funds from various communities. RBI has made it mandatory for banks to lend at least 40% of their credit to select sectors i.e. weaker sections which impact a larger chunk of population. Below is the list of sectors:

Not only on a consolidated basis but RBI has also decided for sub targets. For example Bank ABC gets a deposit of Rs.150 and after complying with mandatory requirement they plan to lend Rs.100. Out of this Rs.100 they will have to lend at least Rs.40 to the aforesaid sectors. Banks while lending to the above sectors will have to fulfill individual target as well. At least 18 %( Rs.18 in our example) should be lent for agricultural activities. At least 10% (Rs.10 in our example) should be for the weaker sections and so on. Ratios differ for domestic and foreign banks. For Foreign banks total priority sector lending target is kept at 32% of total credit. For foreign banks at least 10% (Rs.10 in our example) should be SSI and so on.

Banks need to comply with 40 %/(32% foreign banks) by the end of the financial year. Since this check is done in March end, banks keeps the PRL ratio low for major part of the year and rush for the same in the last few months. Banks are the key investors in securitized products having underlying credit from any of the above sectors. A microfinance company normally charges ~26-28% for a loan. After they have completed their capital (lending borrowers) they package those assets and sell the securitized asset to banks with a yield of ~10-14%. Banks happily apply for it even at 10% given this investment also complies with RBI’s PRL requirement. (Note banks consider rating of the asset before buying ht same)

What if Banks fails to comply with this requirement?

Banks have to make up for the balance and deposit it with institutions as asked by RBI. Let’s continue with our example. If bank fails to lend Rs.40 and instead offers only Rs.35 by march end towards PRL then bank is mandated to invest the balance with rural infrastructure development fund (RIDF). RIDF is a government organization operated by NABARD and funds projects related to rural roads, irrigation, flood protection and related rural activities.

What will be the return offered by RIDF?

This depends on the quantum by which bank failed to keep up its mandated requirement. In our example bank’s shortfall was at 5% (Rs.40-Rs.35) and so it will be paid bank rate less 2%. See below

Foreign banks need to lend the shortfall to Small Enterprise Development Fund (SEDF) which is managed by SIDBI.

More about Kush Sonigara on Google+

More about Kush Sonigara on Google+